We show you how to calculate Inheritance Tax in Valencia so that you can see how much you will have to pay for inheriting a house in this region.

Undoubtedly, one of the main doubts that assail our clients when they inherit property is this: How much will I have to pay? To calculate the price of inheriting a house in Costa Blanca, the first things to take into account are the costs and taxes that come into play in the operation. Broadly speaking, we would say that there are 3:

- Municipal Capital Gains Tax: depends on each local council.

- Personal Income Tax: this is only applicable if you decide to sell or rent out your home, thereby obtaining a capital gain.

- Inheritance Tax: depends on each Autonomous Region.

It is precisely this last tax, the Inheritance Tax, that we will focus on in today’s article.

*In our Guide to Inheritance Tax in Valencia Region, we answer the most common questions about this tax: How it is calculated, who must pay it, when, and possible deductions established by the region to help you pay less. Download the Guide to Inheritance Tax in Valencia Region and clear up all your doubts regarding inheriting a home

>> Download Inheritance Tax Guide <<

What is Inheritance and Gift Tax?

Inheritance and Gift Tax is a tax on wealth acquired by individuals through inheritance, bequests or donations. At state level, this tax is regulated by Law 29/1987 of 18 December 1987 on Inheritance and Gift Tax and the Regulations of 8 November 1991.

However, the handling of this tax is entrusted to the Autonomous Regions. At regional level, its regulation can vary greatly from one Autonomous Region to another. Specifically, in the Valencia Region it is regulated in Chapter II of the Law of 23 December 1997, recently amended by Law 13/2016, with effect from 1 January 2017.

Calculating Inheritance Tax in the Valencia Region

To find out how much inheritance tax you will have to pay in the Valencia Region, it is best to seek professional advice. Inheritance tax is a complex tax and the deductions or allowances to be applied vary greatly depending on the value of the inherited property and your degree of kinship with the deceased.

If you are going to sell an inherited property in Costa Blanca, you can contact Hispania Homes. As well as helping you to calculate and settle this tax, they will also advise you on the sale to ensure you achieve the maximum benefit.

If you would like to gather information about the process you are about to embark upon, here are the steps you need to follow to calculate Inheritance Tax in the Valencia Region.

1. How to determine the Gross Tax Base

The first thing to do is to determine the gross tax base, i.e. the total amount of the estate received. To do this, the total value of the inherited assets must be added and deductible debts and charges must be subtracted. The result of this operation will be the Gross Tax Base.

2. How to determine the Net Tax Base

The net tax base is the result of applying a series of deductions to the gross tax base. Below you will find the deductions on Inheritance Tax established by the Tax Agency of the Valencia Region.

Kinship deduction

The following deductions for kinship are established for Inheritance Tax in the Valencia Region:

- Acquisition by descendants and adopted children under 21 years of age: deduction of 100,000 euros, plus 8,000 euros for each year under 21, not exceeding 156,000 euros.

- Acquisition by descendants and adopted children over 21 years of age, spouse, ascendants and adoptive parents: deduction of 100,000 euros.

Other deductions

- Acquisitions by heirs with a disability equal to or greater than 33%: deduction of 120,000 euros plus the deduction for kinship. If the degree of disability is 65% or more, the deduction will be 240,000 euros.

- Acquisition of the deceased’s main residence: deduction of up to 95% of the value of the home, up to a limit of 150,000 euros.

- Transfer of an individual agricultural company, professional business or shares in entities: deduction of up to 95% of the value of the transferred assets.

- Transfers of cultural heritage assets: deduction according to the period of transfer of the asset at the following rates:

- 95%, for periods of more than 20 years.

- 75%, for periods of more than 10 years.

- 50%, for periods of more than 5 years.

3. How to determine the Full Amount

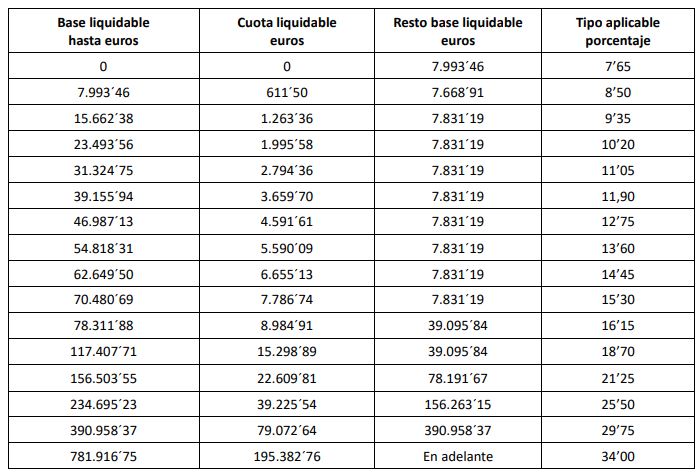

Once the net taxable base has been obtained through the deductions established for each population group, the tax rate must be applied according to the result obtained. Each autonomous region establishes its own tax rates, although they are usually between 7.65% and 34%.

When calculating Inheritance Tax in Valencia, we must resort to the following table established by this region’s Tax Agency.

Inheritance Tax Rate in Valencia Region | Source: Conselleria D’hisenda i Model Econòmic Direcció General de Tributs.

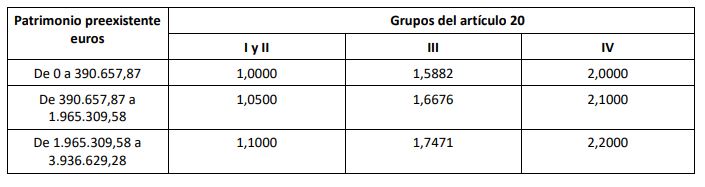

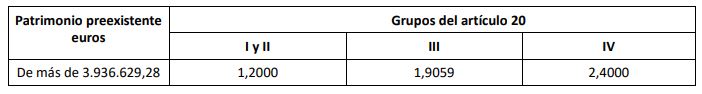

4. Tax Burden

The next step to calculate what we will have to pay for inheriting a house in Valencia will be to multiply the full amount obtained in the previous step by the multiplier coefficient established by this region’s Tax Agency. The greater the degree of kinship between the deceased and the heir, the lower this figure will be.

5. Regional bonuses on the Tax Burden

Finally, all that remains is to apply the following regional bonuses to reduce the amount to be paid:

The following regional bonuses will be applied to the tax burden:

- 75% bonus: mortis causa acquisitions received by relatives of the deceased belonging to Kinship Group I.

- 50% bonus: mortis causa acquisitions received by relatives of the deceased belonging to Kinship Group II.

- 75% bonus: mortis causa acquisitions received by persons with a physical or sensory disability with a degree of disability equal to or greater than 65% or by persons with a mental disability with a degree of disability equal to or greater than 33%.

*We remind you that if you intend to sell an inherited house in Costa Blanca you can consult our real estate services. Please find below our Guide to Inheritance Tax in Valencia so that you can learn more about the process.